Life Insurance in and around Chicago

Protection for those you care about

Life happens. Don't wait.

Would you like to create a personalized life quote?

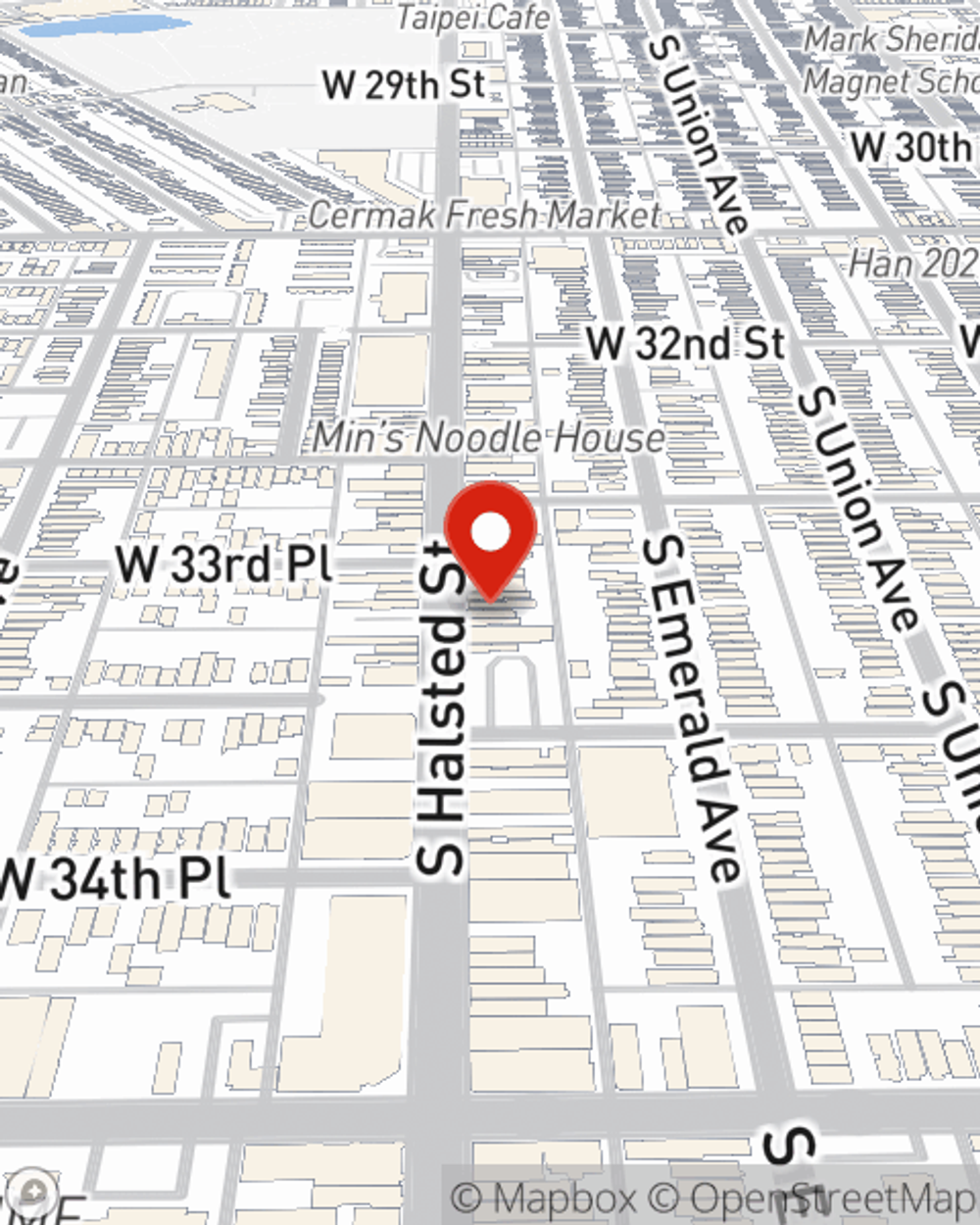

- Back of the yards

- Little Village

- Pilsen

- Chinatown

- Bronzeville

- Downtown Chicago

- Fulton Market

- River North

- Cicero

- Berwyn

- Humboldt Park

- Evergreen Park

- West Loop

- Logan Square

- East Garfield Park

- South Side

Your Life Insurance Search Is Over

It can be what keeps you going every day to provide for those closest to you, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can maintain a current standard of living and/or keep paying for your home as they face the grief and pain of your loss.

Protection for those you care about

Life happens. Don't wait.

Wondering If You're Too Young For Life Insurance?

And State Farm Agent Carlos Aguilar is ready to help design a policy to meet you specific needs, whether you want level or flexible payments with coverage designed to last a lifetime or coverage for a specific time frame. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

State Farm offers a great option for individuals who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can be helpful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For help with all your life insurance needs, contact Carlos Aguilar, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Carlos at (773) 893-5200 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Carlos Aguilar

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®